Introduction

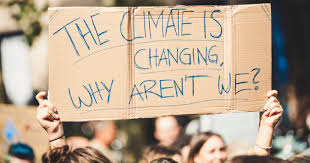

In a striking blend of trade policy and domestic security rhetoric, former U.S. President Donald Trump recently announced sweeping tariffs targeting China, Canada, and Mexico—framing the move as a direct response to “out-of-control illegal immigration and drug trafficking.” The decision has sparked fierce international backlash, with all three nations pledging immediate countermeasures. This article unpacks the geopolitical chess game unfolding at the intersection of commerce, border security, and global diplomacy.

Trump’s Tariff Justification: Why Link Trade to Immigration and Drugs?

The Unconventional Rationale

Trump’s latest tariffs—25% on $300 billion of Chinese goods and 10% on Canadian and Mexican steel—were justified not by traditional trade deficits but by claims that these nations “enable border chaos.” In a fiery speech, Trump argued:

- “Cheap Chinese fentanyl floods our streets, while Mexico’s cartels profit from human smuggling.”

- “Canada’s lax border policies let traffickers exploit our northern frontier.”

Fact-Checking the Claims

- Fentanyl Flow: While China remains a primary source of fentanyl precursors, 90% enter the U.S. via Mexico (U.S. DEA, 2023).

- Northern Border Concerns: Only 2% of U.S. drug seizures occur at the Canada border, per Customs and Border Protection (CBP) data.

Critics Push Back

Economists and policy experts call the linkage “a dangerous precedent.” Former U.S. Trade Representative Michael Froman noted: “Using tariffs as a cudgel for non-trade issues undermines WTO frameworks and invites chaos.”

China’s Response: Precision Strikes and Diplomatic Firestorms

Retaliatory Tariffs: Targeting Trump’s Base

China’s Commerce Ministry announced 30% tariffs on:

- U.S. agricultural exports: Soybeans, pork, and dairy—hitting Midwest swing states.

- Luxury goods: Harley-Davidson motorcycles and Kentucky bourbon.

The Propaganda Playbook

State media outlet Global Times framed the tariffs as a defense against “U.S. scapegoating,” while Beijing lodged a formal WTO complaint alleging “politicization of trade rules.”

The Fentanyl Factor

In a calculated twist, China pledged to “strictly regulate precursor chemicals”—but tied cooperation to the lifting of tech sanctions on Huawei.

Canada’s Counterpunch: Diplomacy Meets Steel

Tariffs With a Smile

Prime Minister Justin Trudeau imposed 15% tariffs on:

- U.S. steel and aluminum.

- Consumer goods: Florida orange juice, Wisconsin toilet paper, and Kentucky whiskey.

Legal Leverage

Canada is mobilizing the USMCA’s dispute resolution clause, arguing Trump’s tariffs violate Chapter 31’s “national security exemption” terms.

The Northern Border Rebuttal

Public Safety Minister Dominic LeBlanc dismissed Trump’s claims as “baseless,” noting Canada deports 90% of illegal U.S. border crossers within 30 days.

Mexico’s Tightrope: Tariffs Versus Migration Talks

Retaliation vs. Pragmatism

Mexico’s retaliatory 20% tariffs target:

- U.S. corn and soy-based products.

- Texas crude oil imports.

Yet, President Andrés Manuel López Obrador (AMLO) avoided escalating rhetoric, stating: “We’ll defend our economy but remain committed to bilateral cooperation on migration.”

The Cartel Conundrum

AMLO unveiled a new “Border Fusion Force” to intercept fentanyl shipments—a move analysts see as appeasing Trump while avoiding direct blame.

Remittance Resilience

Despite tariffs, Mexico benefits from $63 billion in annual U.S. remittances—a lifeline AMLO won’t risk.

Global Fallout: Who Pays the Price?

Supply Chain Snarls

- Auto Industry: Ford and GM warn of $4 billion in combined costs from steel tariffs.

- Agriculture: Iowa soybean futures dropped 8% post-China tariffs.

Inflation Fears

The Peterson Institute estimates U.S. consumers will absorb 85% of tariff costs—spiking prices on electronics, apparel, and cars.

Diplomatic Rifts

- USMCA in Jeopardy: Canada and Mexico may delay ratification of pending trade provisions.

- NATO Strain: Trudeau’s government hints at reviewing U.S.-Canada defense pacts.

FAQs: Untangling the Tariff Turmoil

1. Can Trump Legally Tie Tariffs to Immigration?

Under Section 232 of the Trade Expansion Act, presidents can impose tariffs for “national security”—a term left undefined, creating legal gray areas.

2. How Will This Impact U.S. Drug Trafficking?

Experts say tariffs could backfire: Cutting Chinese fentanyl precursors may shift production to Mexican labs, worsening overdoses.

3. What’s China’s Endgame?

Beijing aims to fracture U.S.-North American alliances by offering Canada and Mexico BRI-style infrastructure deals.

4. Could This Reignite Global Trade Wars?

Yes. The EU and ASEAN nations are drafting retaliatory plans anticipating Trump-era policies spreading.

5. How Might Biden Respond If Re-Elected?

Likely reversal of tariffs but retention of border security measures—a “decoupling” strategy to appease allies.

Conclusion: A New Era of Weaponized Trade Policy

Trump’s fusion of tariffs and border politics marks a seismic shift in global economic strategy. While China, Canada, and Mexico mount swift defenses, the broader lesson is clear: In an era of fragmented alliances, trade is no longer just about goods—it’s a battleground for ideology, security, and power. The world is watching, wallets in hand.